Outrageous Info About How To Deal With Medical Bills

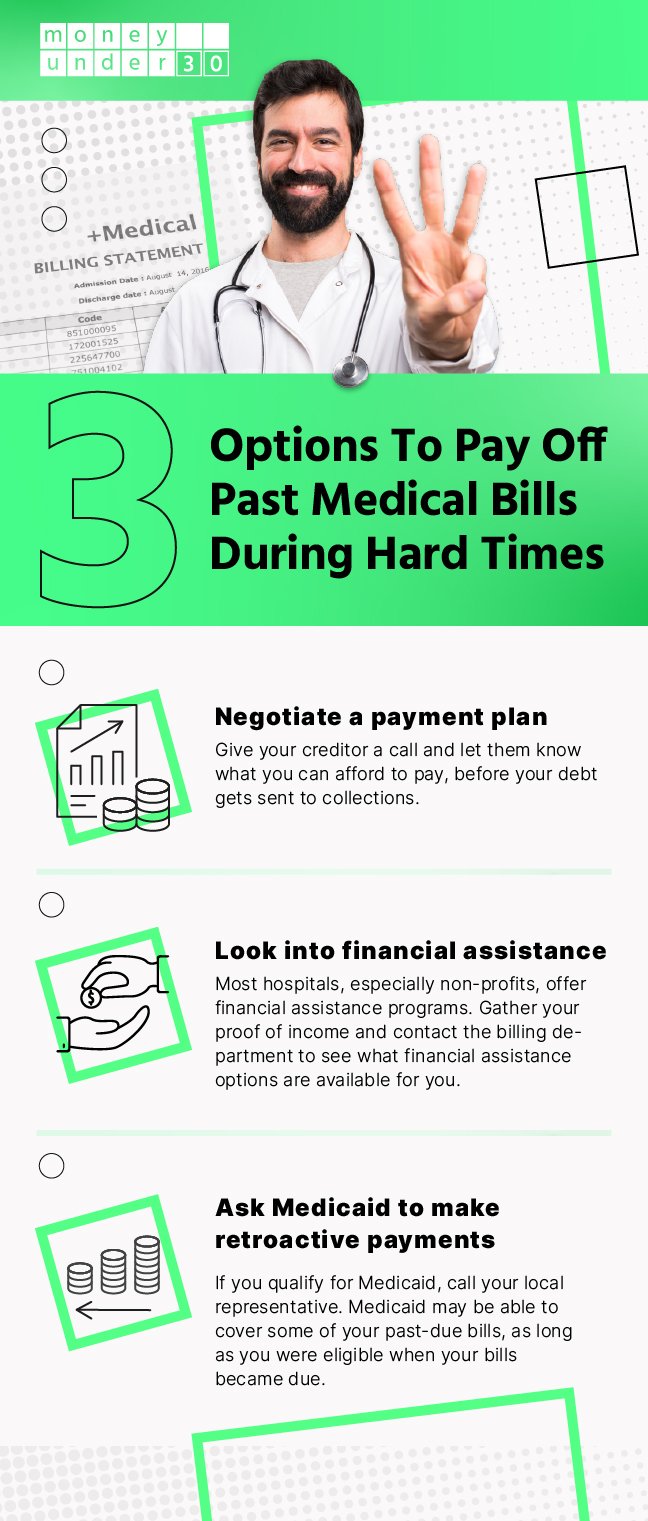

This payment plan can be helpful if you cannot afford to pay the bill in full.

How to deal with medical bills. Next, ask the debt collector to send verification of the debt. Even though you’re filing a bankruptcy case to get rid of overwhelming medical debt, you won’t be able to limit the case to. 5 doctors most likely to stick you with surprise medical bills 2.

Getting a personal loan may be best. Review medical bills for accuracy. Professional medical bill negotiators save up to 90%.

The cost of medical debt can be well outside of anyone’s reasonable budget, so one of the first things you should do is arrange for a good payment plan. The last thing you want is to pay for. Monitoring your credit will allow you to catch any erroneous medical collections that are added to your credit reports so that you can.

Another way to negotiate medical bills is to set up a payment plan. Type “medical bills” so we know which expenses you’re struggling with. You can also try negotiating with the hospital.

If you are facing significant medical debt, the first thing you should do is to review all of the medical bills to make sure they are completely. Check your credit reports regularly: But it does require some legwork.

If you want to negotiate your bill, speak with your healthcare provider’s medical billing manager—the person who actually has the authority to lower your bill. Also beginning in july 2022, the credit bureaus states will remove all paid medical debt from credit reports. Log in to your donotpay account via a web browser.