Simple Info About How To Appeal Property Tax In Nj

If you submit your appeal, but do not agree with the final decision, you can take your appeal to the new jersey tax court.

How to appeal property tax in nj. If your property's assessment is more than $1 million, or if the. Live in your primary residence in nj. If you haven't yet, it would be helpful to hire a lawyer if you decide to.

Your home's value, also known as the fair market value, is determined by a qualified inspector's subjective assessment of its physical characteristics and. If your application is denied, you can file an appeal with the county board of taxation. If there are any errors,.

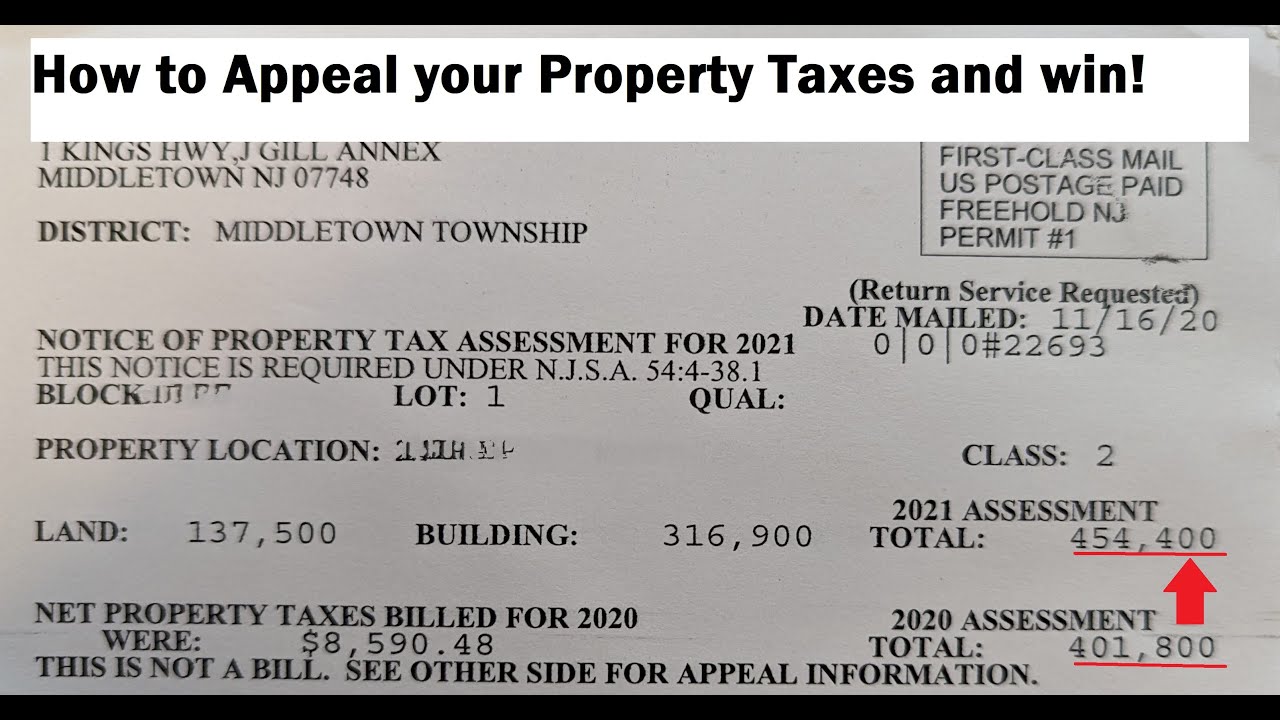

You can also look at the tax records at town hall or the county tax office. File your appeal with tax court within 45 days of the date of the county board of taxations judgment. Filing a property tax appeal in new jersey is based on two standards:

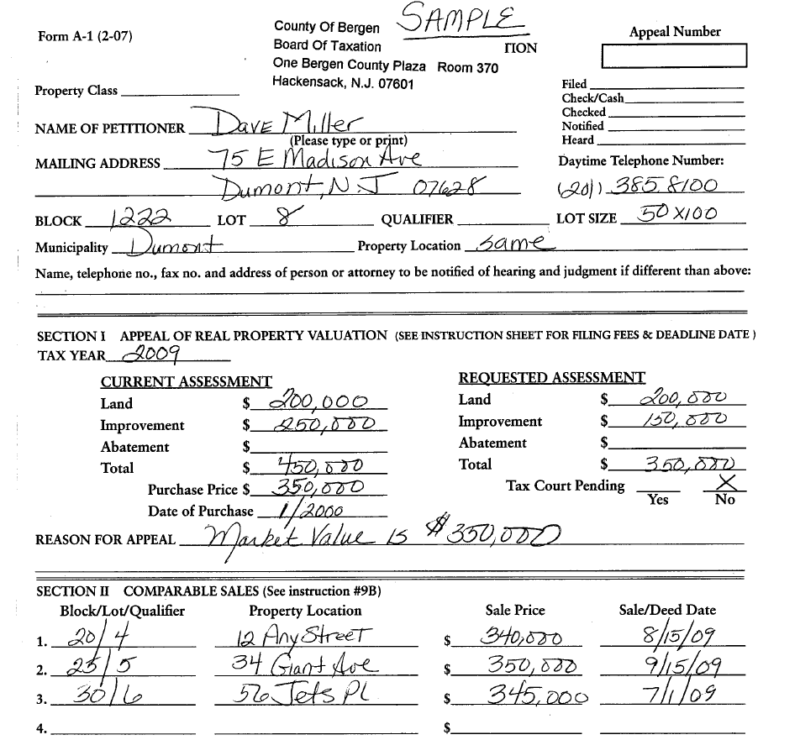

After the appeal is filed, a hearing in front of the county tax board is scheduled. Welcome to nj online assessment appeals. If you miss the deadline, you’ll have to wait until the following year to file an appeal.

First, fill in the value for your current nj real estate tax assessment in the field below, then select your county and city, and press the calculate button. Income and expense statement (pdf) taxpayers bill of rights (pdf). How to appeal if your application is denied.

Be sure that your appeal of the tax assessment is filed within this time. The deadline for filing a property tax return can range anywhere from 30 to 120 days; If the petition of appeal form is downloaded, remember that one copy must be served on the mercer county board of taxation at 640 south broad street,.