One Of The Best Info About How To Apply For Homestead Exemption In Broward County Florida

*disclosure of your social security number is.

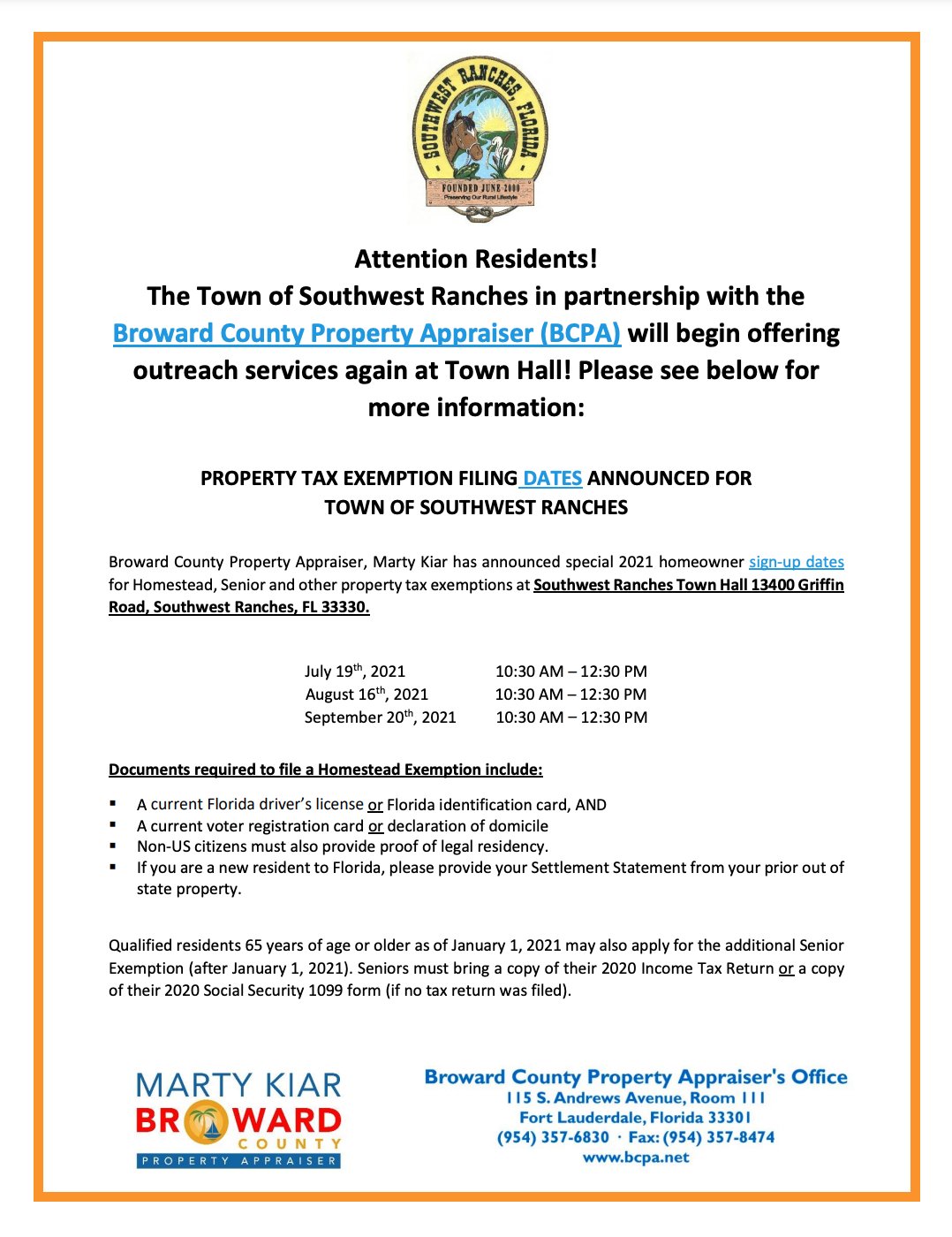

How to apply for homestead exemption in broward county florida. If you are looking for how to file for homestead exemption in brevard county, keep reading. How to apply for a homestead exemption. In order to apply for homestead for the first time, an owner must have moved into the home prior.

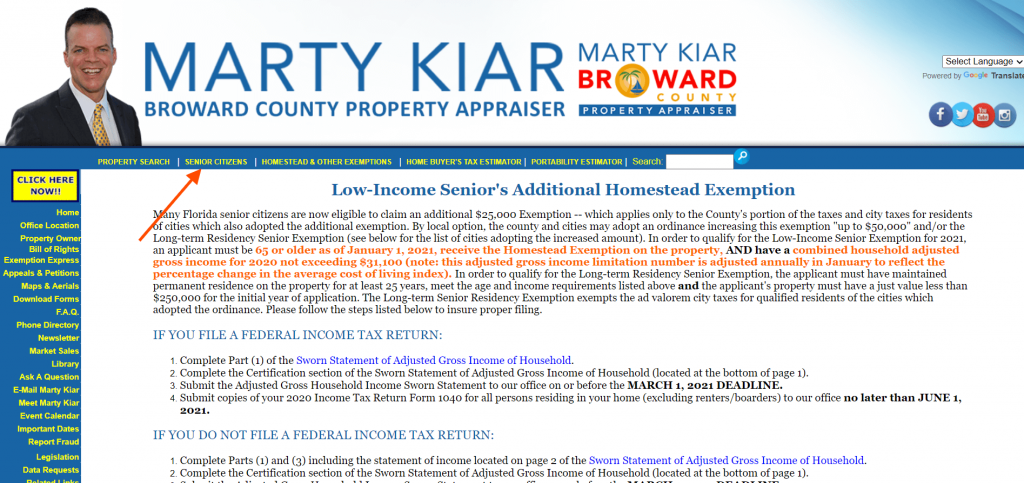

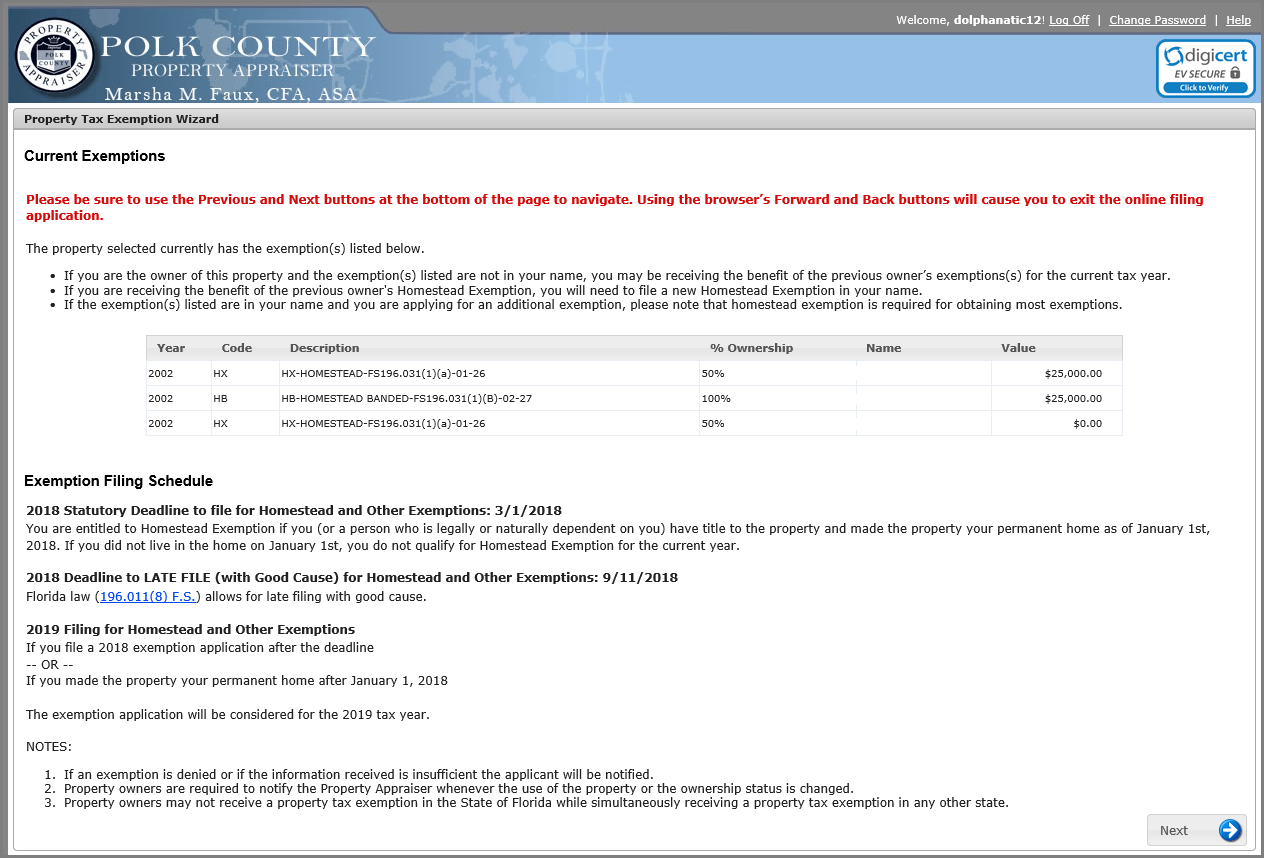

Property owners with homestead exemption and an accumulated soh cap can apply to transfer (or port) the soh cap value (up to $500,000) to a new homestead property. The homestead exemption and save our homes assessment. If your household has a high income, you can qualify for a homestead exemption.

Welcome to the broward county property appraiser's. Application due to property appraiser by march 1. You must first apply for a homestead exemption in order to be eligible for portability.

For information on homestead exemption in broward county, see the broward county property appraiser web site. Permanent florida residency required on january 1. There are two ways to apply, depending on certain criteria.

This lowers the assessed value of the homestead. You should make a certain amount of dollars to be eligible for an exemption. Homestead exemption applications must be filed with the county property appraiser by march 1st of the tax year for which the exemption is sought.

Property owners in florida may be eligible for exemptions and additional benefits that can reduce their property tax liability.